Cost Adjustments

Cost adjustments can now be made to any service or item detail line on a job.

There are two types of cost adjustments a debit and credit cost adjustment.

A debit adjustment increases the cost and a credit adjustment decreases the cost.

Both types of adjustments do not increment or decrement quantities.

Costs adjustments are particularly useful for updating a job after the cost of an inventory item or contractor charge has changed after the relevant line has already been posted in the job and no longer reflects the true cost.

Cost Debit Adjustment Working Example

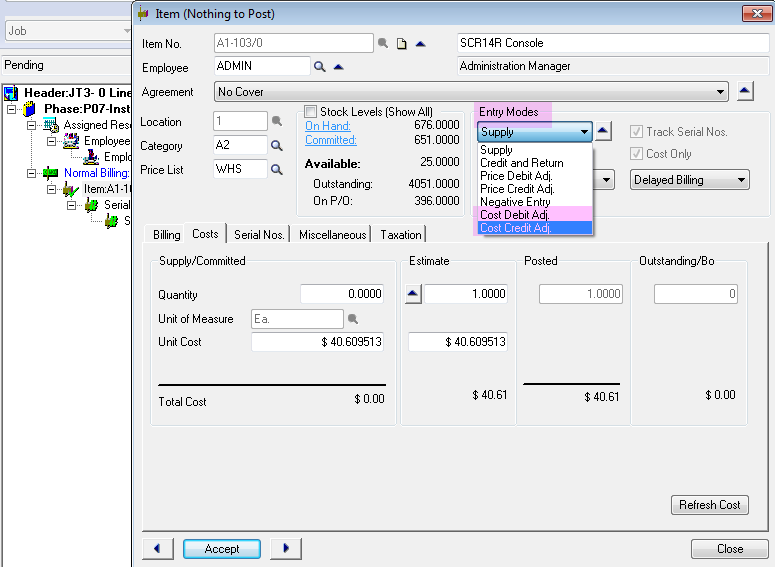

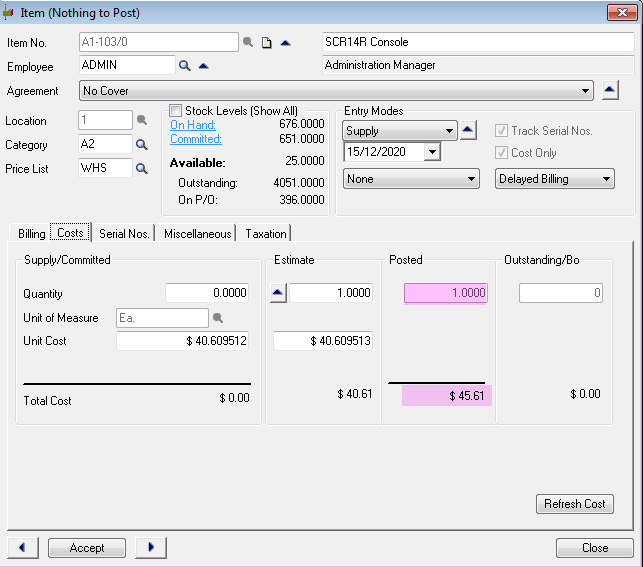

In the screen below an item has been posted at a cost of $40.61.

Select Cost Debit Adj. to increase the cost of that line.

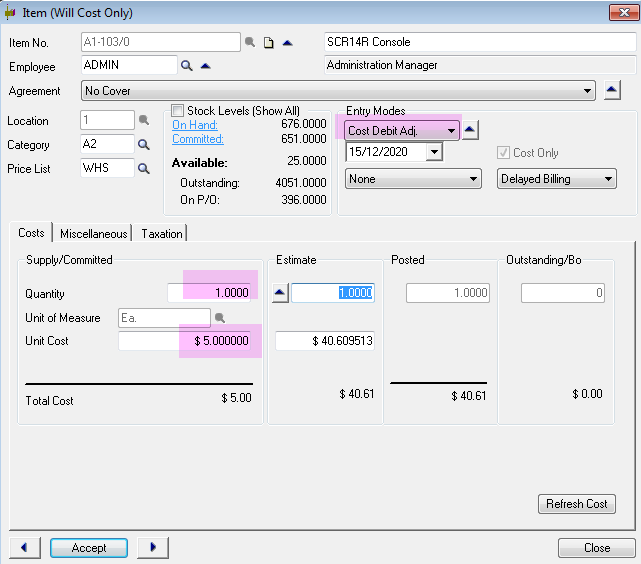

In the example below cost is increased by $5.00.

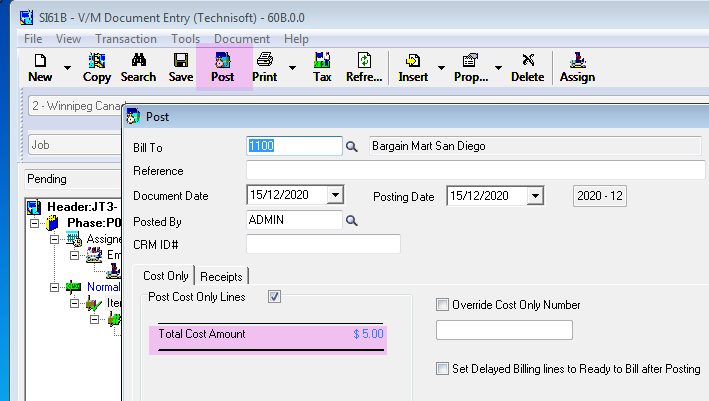

Post the Cost Debit Adjustment.

After the Cost Debit Adjustment has been posted the item cost has increased by $5.00 without changing the quantity posted.

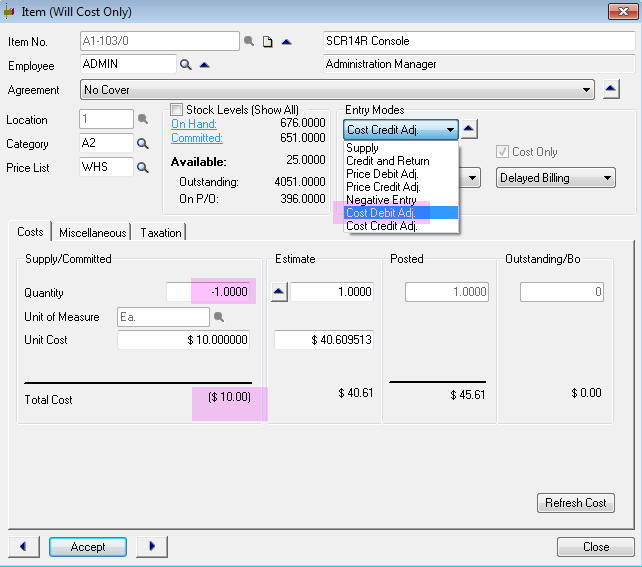

Cost Credit Adjustment Working Example

In the example below $45.61 is the posted cost and a Cost Credit Adjustment is being applied for $10.00.

This will reduce the cost by $10.00 without impacting the quantity.

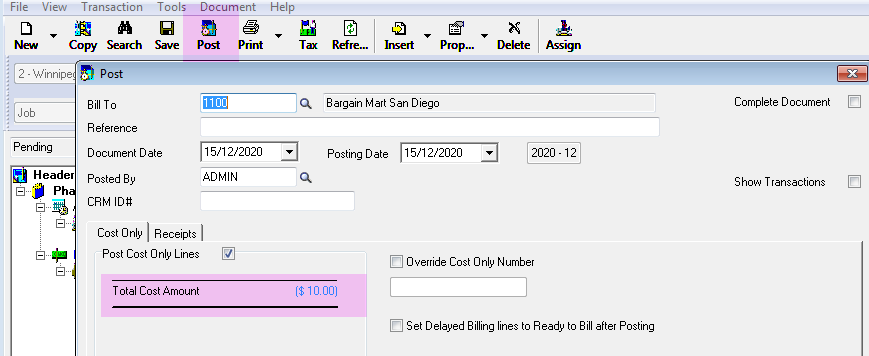

Post the Cost Credit Adjustment.

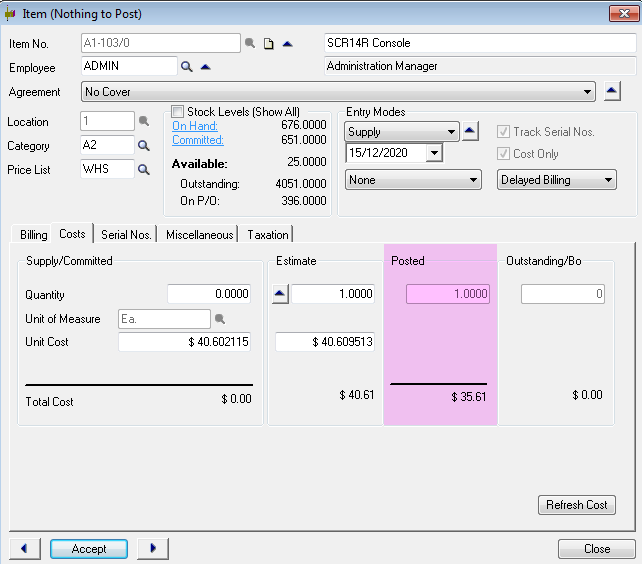

After the Cost Credit Adjustment has been posted the item cost has decreased by $10.00 to $35.61 without changing the quantity posted.