Crediting an Amortization

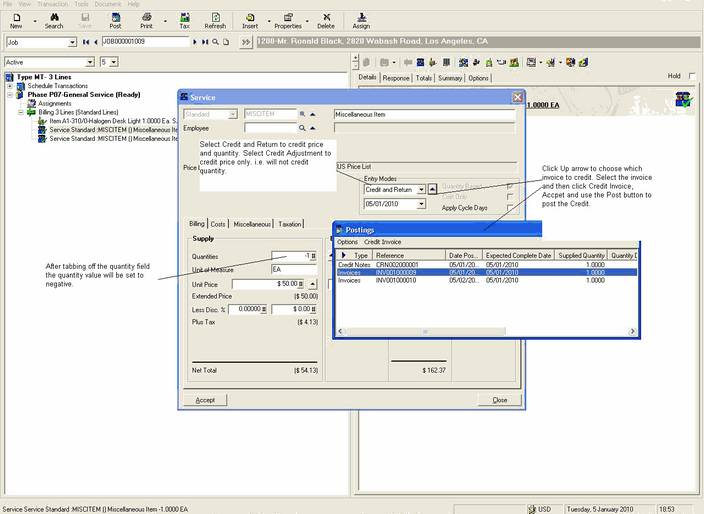

To credit amortization lines, do not use the Credit Invoice option as that will credit the entire invoice and not the unposted amortizations to date.

Each amortization schedule is attached to a separate Service line.

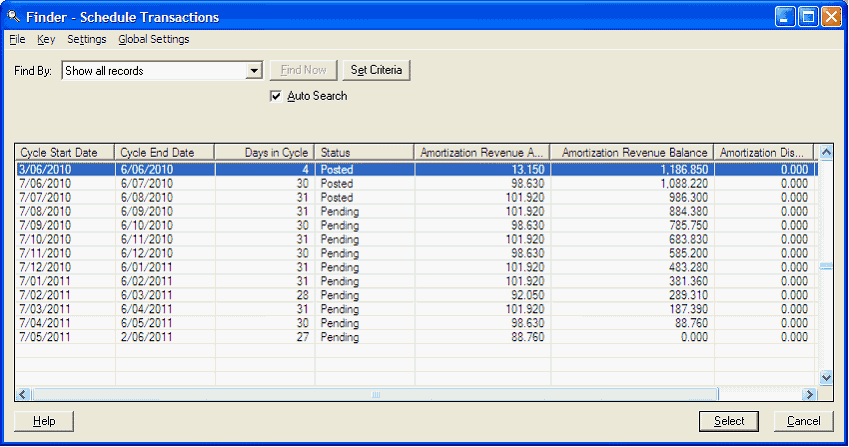

The unposted (Amortized) remaining entries will be adjusted to the new values after the credit.

The following screen shots show an example of the results.

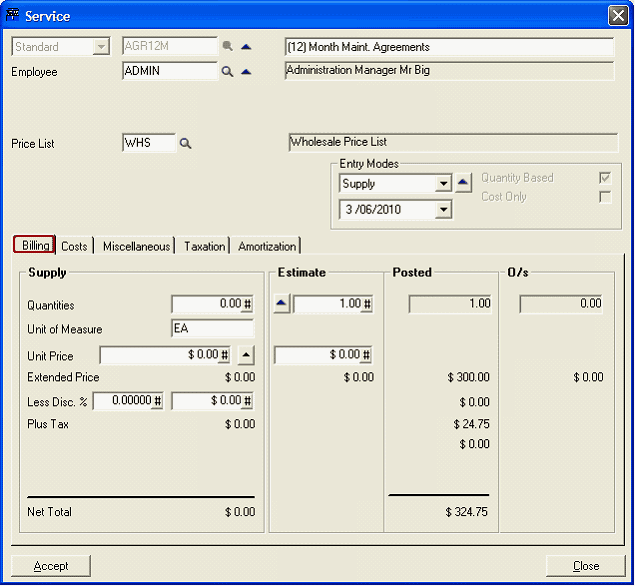

After Posting Invoice

Three Posted Amortized values after 3 months

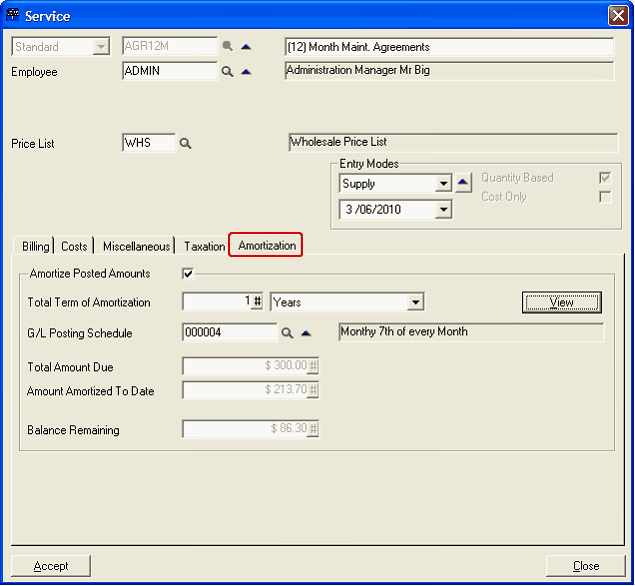

After applying Credit Adjustment

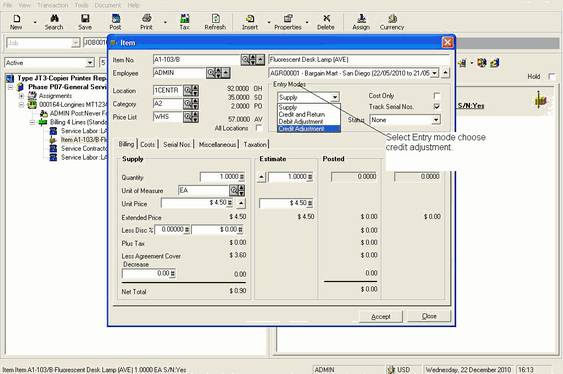

It depends on whether you are completely crediting the line and the remaining amortization values or passing a credit adjustment.

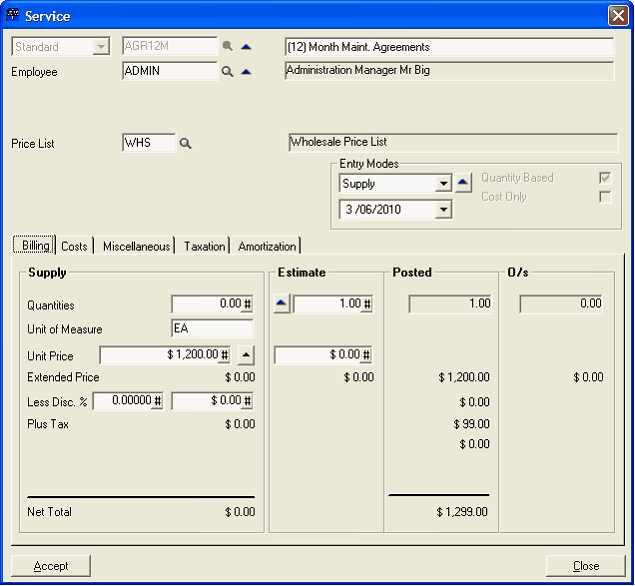

Let’s say you have an Agreement that auto posts an invoice yearly with an monthly amortized line for $1,200. You run the normal posting schedule to generate the due invoice. This will create 12 amortization entries varying in value based on the days in each cycle.

Three months later you cancel the agreement and wish to credit the remaining nine months of posted invoice. You will need to apply a credit adjustment which will only credit the price posted and not the quantity. If you credit the quantity you will have no quantity posted and this would cause the [View] Amortization button to disappear.

After the credit has been posted, you will see the total amount to be amortized reduced from $1,200 to $300. And since we have already amortized three months, there will be a small residual that will remaining to be amortized across the remaining nine months. Basically it is trying to amortize the posted $300 across the rest of the year.

So the trick is not to perform a straight credit, but a credit adjustment to value only.

One major thing to look out for with this is that if you are using Posting Schedules, you must reset the lines' supply values after the credit back to what you want to post annually if there is to be ongoing billing. If, as in the example above, you are canceling, then you should remove any outstanding posting schedules and clear the supply values.