Item Refurbishment

Overview

An Item Refurbishment function has been added at the Billing Group or Task Billing Group level within a Job.

This function provides the ability to take an item from stock and perform additional work on it consuming services and items in the process, and then adjust the cost for those services and items back into inventory against that part.

It is also possible to select an item that is not in stock (serial or non serialized), refurbish it and adjust it, by both quantity and cost, back into stock.

This Refurbishment feature is invaluable where equipment or a part being serviced (whether on a customer or internal job) is returned to stock into a temporary location using the Returns program where it will later be added to another job to be refurbished and subsequently adjusted back into stock for resale or use as applicable.

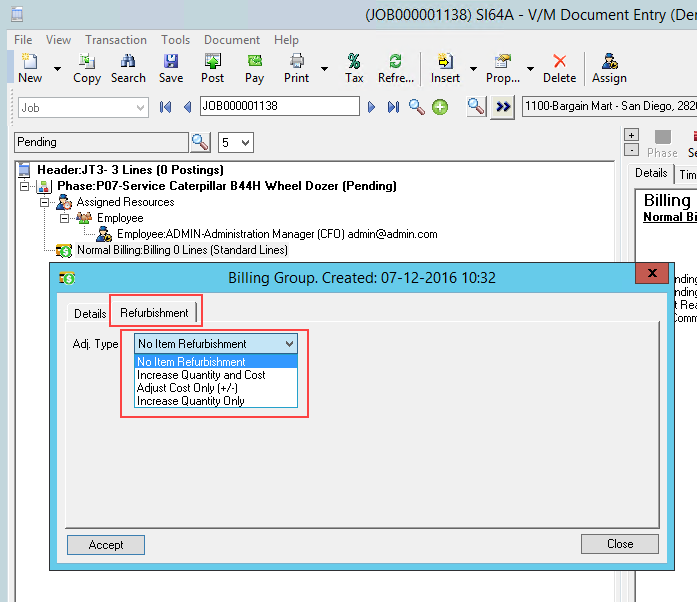

There are four Refurbishment Adjustment Types;

•No Item Refurbishment

•Increase Quantity and Cost - This is used when the cost needs to be increased and the item added to stock.

•Adjust Cost Only (+/-) - This is used when the part is already in inventory and only the cost needs to be increased.

•Increase Quantity Only - This is used to add the item to inventory but make no adjustments to costs.

An IC Adjustment is generated in order to process the refurbishment.

Principles are not too dissimilar to the Returns function and posting of the Refurbishment occurs from the “Returns and Refurb” program.

Note: All Items and Services consumed during refurbishment are set to be “Cost Only” or Non Billable.

If the item being Refurbished is to be later sold or used, the Refurbishment must first be completed by posting an IC Adjustment in the “Returns and Refurb” program and then placing the refurbished item back onto a job to be billed or consumed as a cost only item as applicable.

How to Enter A Refurbishment

Refurbishment workflow:

•Add a Refurbishment type Billing Group

•Add Items and Services

•Post Document Entry

•Set Refurb Billing Group to Ready to Return

•Run Day End

•Open Refurbishment Program

•Post Refurbishment line.

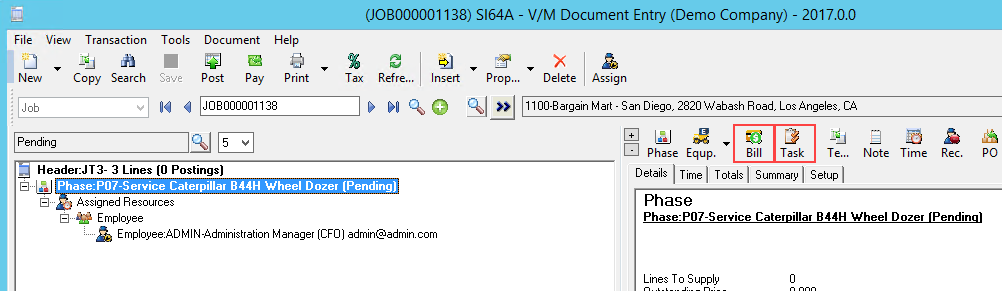

Add a Billing Group

Add a Billing Group or Task Billing Group to a Job.

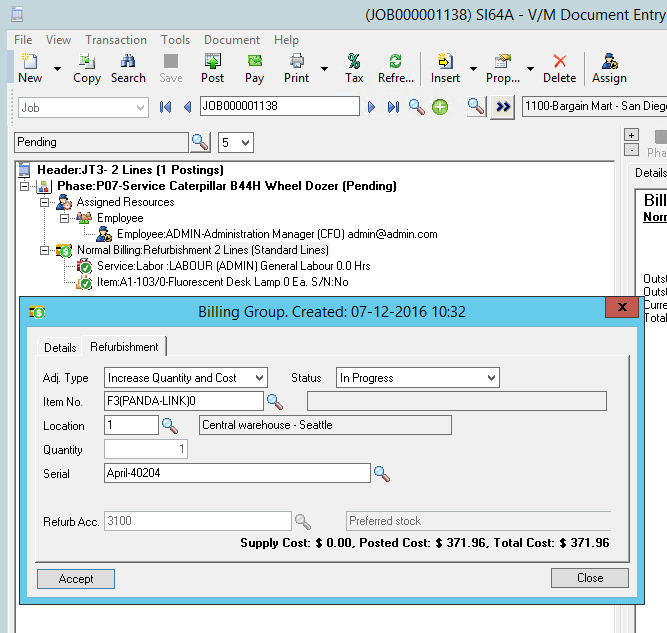

Select properties on the Billing Group or Task and select the Refurbishment tab.

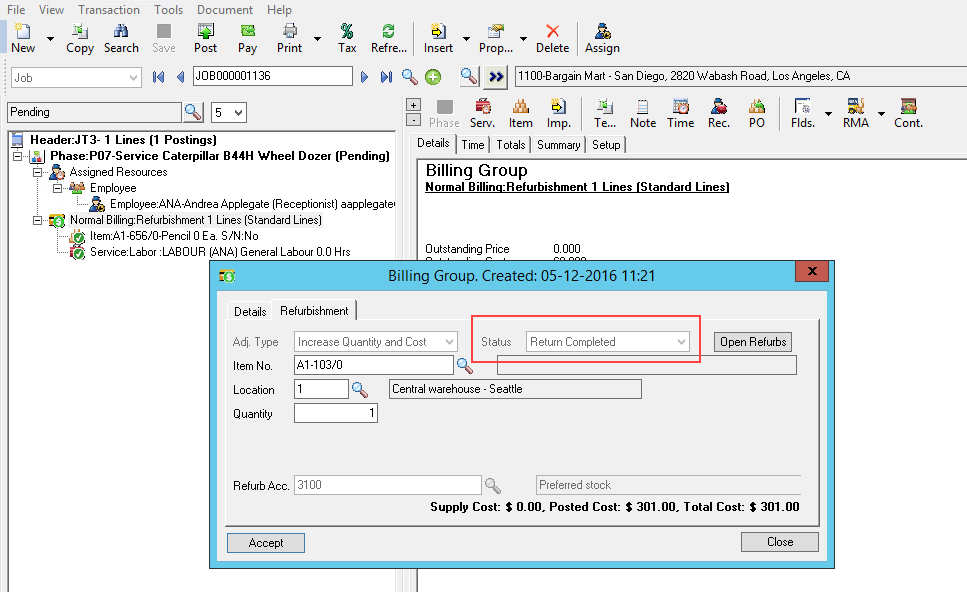

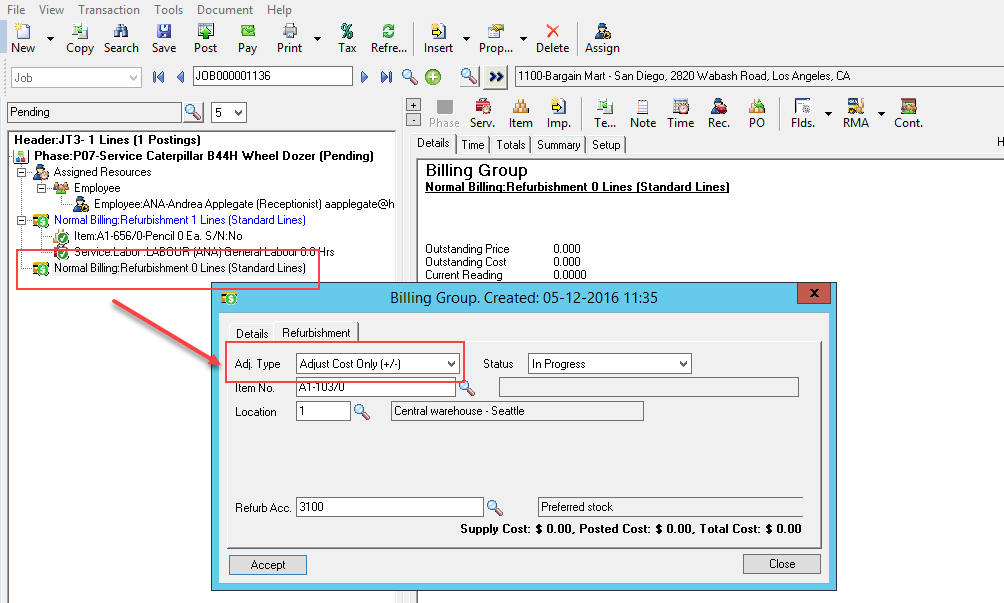

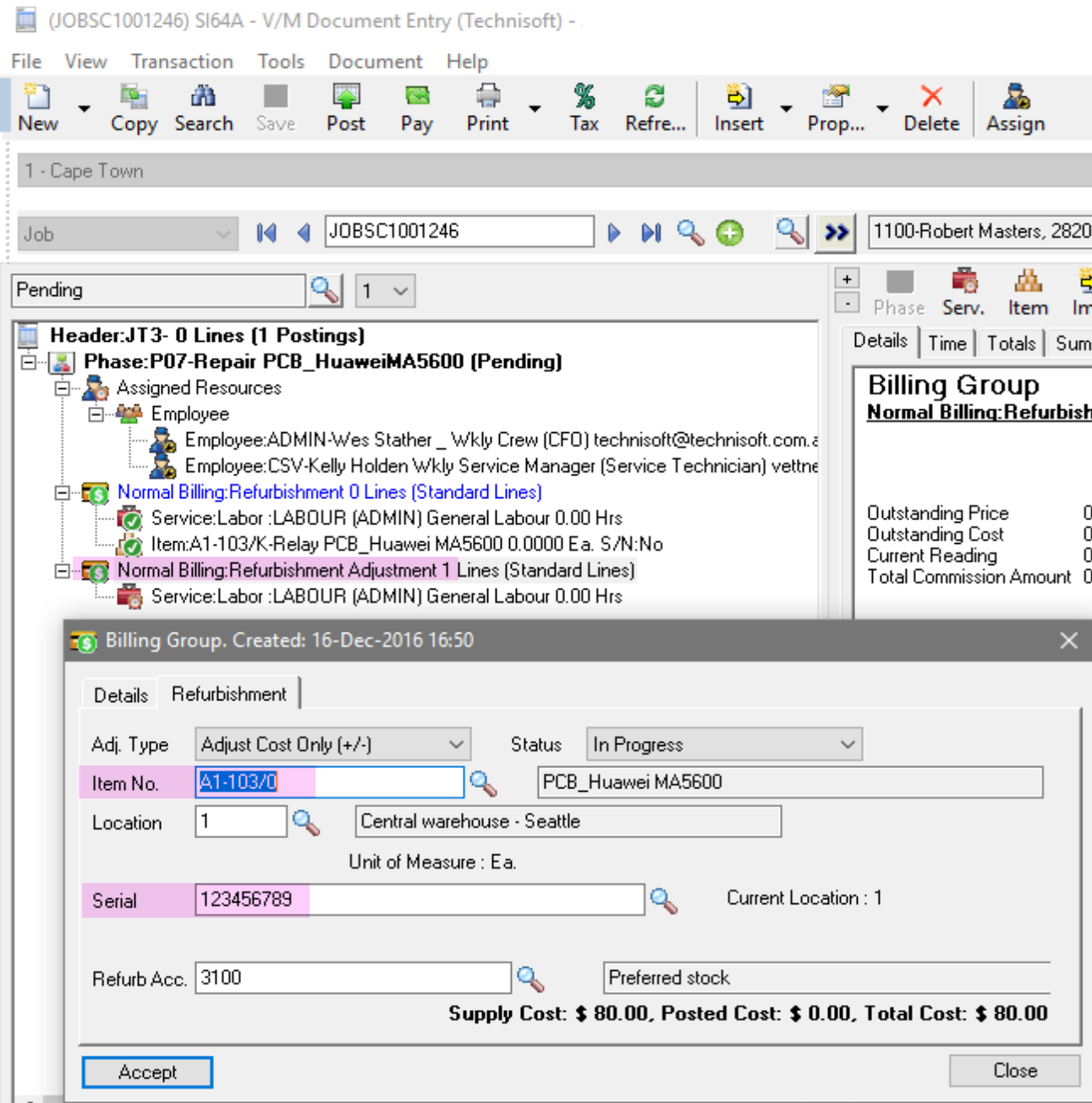

Select Adjustment Type

"No Item Refurbishment"

“Increase Quantity and Cost” adjusts the quantity of the item selected back into stock using the cost of services and item consumed on the job in the specified Billing Group or Task.

"Adjust Cost Only (+/-)" adjusts the cost of services and items consumed on the job back into the stock, either increasing or decreasing the cost, for the item selected. Refer Adjusting a Refurbishment

“Increase Cost Only” adjusts the cost of services and items consumed on the job back into the stock, increasing the cost, for the item selected.

Set Status

•In Progress – set this status whilst working on the Refurbishment. This is the default status.

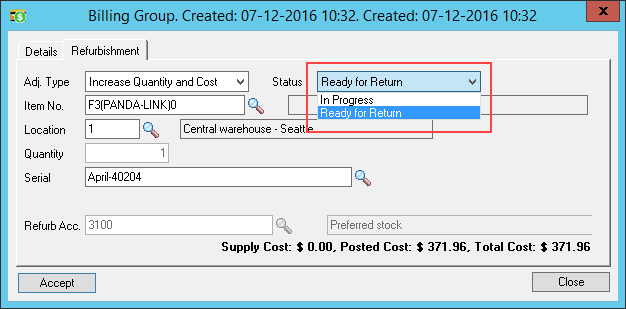

•Ready for Return – Once Refurbishment work is complete, set the Status to Ready to Return. The Refurbishment can then be retrieved into the Returns and Refurbs program and Posted to an IC Adjustment.

•Posted to Returns – Once the Status is set to “Ready for Return” the next step is to open the “Returns and Refurb” program and select the “Refurb” icon in the top tool bar to retrieve all the “Ready to Return” transactions into the “Returns and Refurb” program. This status is set automatically by the system and cannot be modified.

Note: Once the Refurbishment have been retrieved to the “Returns and Refurb” program it is not possible to edit or modify the associated Billing Group or Task, nor services or item transactions under those Billing Groups or Tasks. If the Refurbishment transaction is deleted before it is Posted, the Billing Group or Task can be edited again including services and items, however, the Refurbishment GL Account will not be adjusted.

•Return Completed – When the Refurbishment is posted to an IC Adjustment the Refurbishment Status is set to “Return Completed”. This status is set automatically and cannot be modified.

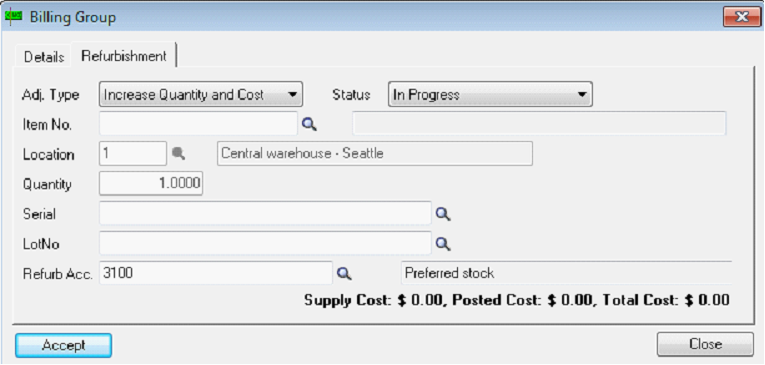

Enter Item Details

•Item No. - Use the Finder to select an existing item number from Inventory.

•Location - Select the location to post the Refurbished Item back to when the IC Adjustment is processed.

•Quantity - If a Non Serialized Item is selected, the quantity field can be modified. Specify the Quantity to return to inventory when the Refurbishment is complete. The Cost from services and items consumed in the Billing Group or Task is pro rated by quantity when the IC Adjustment is posted. If a Serialized Item is selected, the quantity is set to one and cannot be modified.

•Serial - If the Item selected is not serial tracked the Serial Number field will not be visible. If the Item selected is serial tracked, use the Finder to choose an existing Serialized Item to Refurbish. If the item is not currently in stock type in a Serial Number to adjust a new item into stock. In order to do this the Serial Number must conform to the Item Serial Number Mask and the item itself must be Serial Tracked in Inventory Setup.

•Lot No. - If the item is not Lot Tracked this field will not be visible. Select a Lot Number if the Item is Lot Tracked.

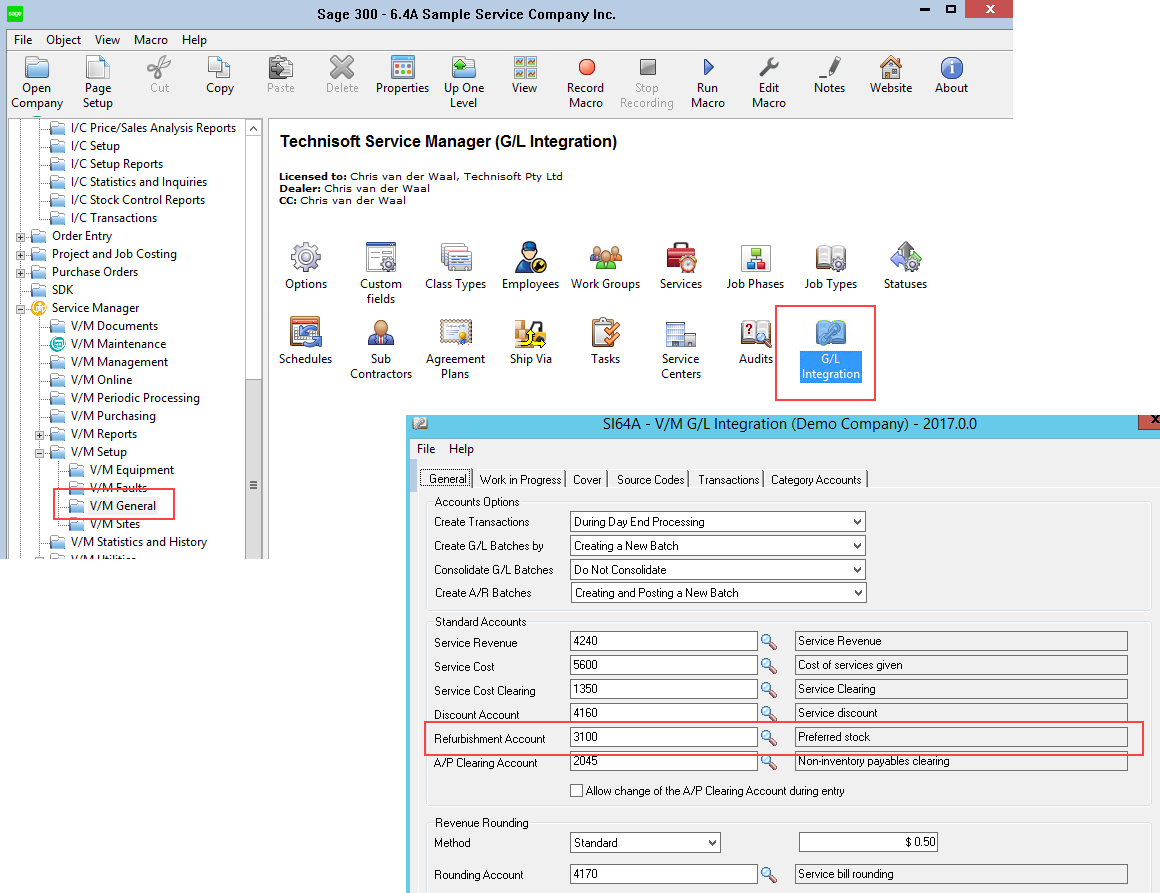

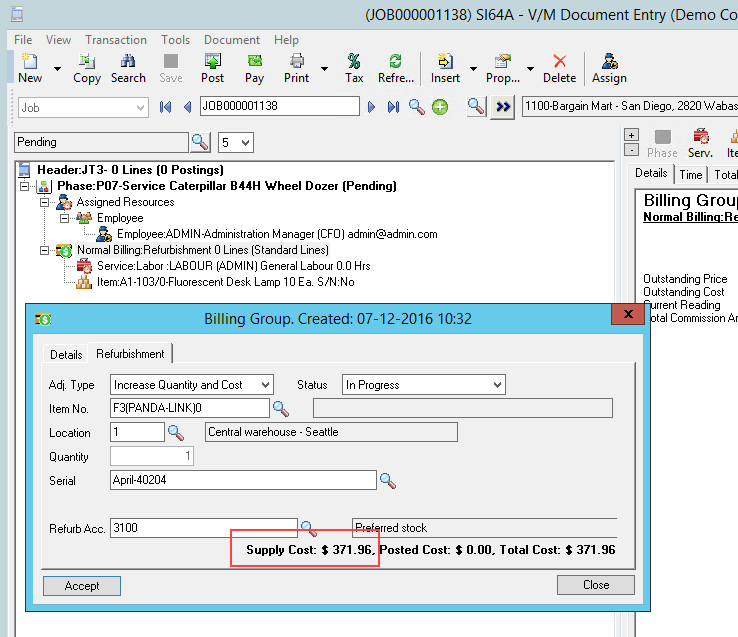

•Refurb Acc. - The Refurbishment Account is a balance sheet clearing account.

The default is specified in V/M Setup, V/M General, GL Integration on the General tab but can be modified by changing the account code (See screen below).

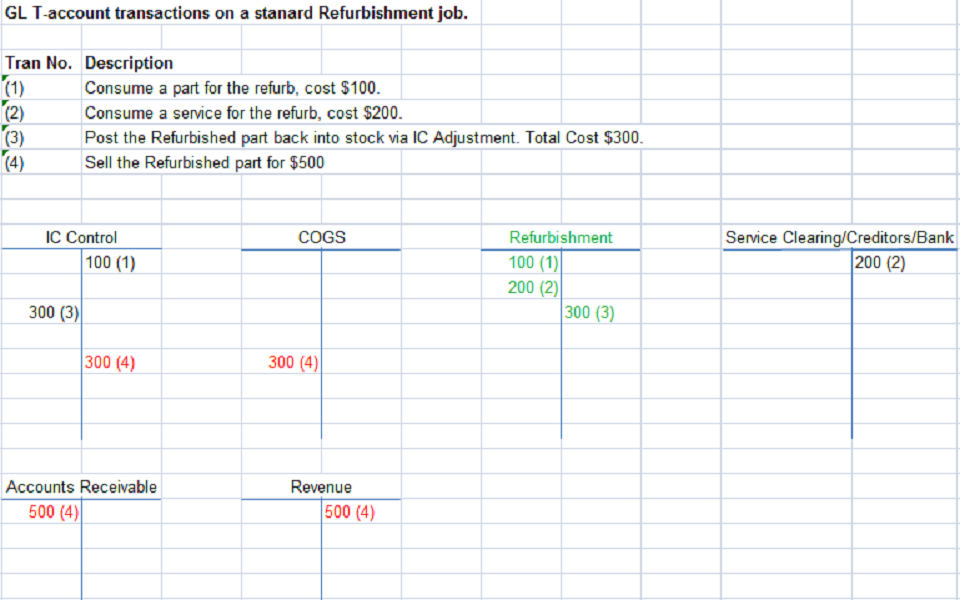

All postings for Items or Services consumed in the Refurbishment Billing Group or Task will be Debited this account and Credited to IC Control or Services Clearing as applicable.

When the Refurbishment is taken up and posted to an IC Adjustment via the “Returns and Refurb” program, a reversal will post a Credit to the Refurbishment account clearing this account and post a Debit to IC Control.

Note that once a posting has occurred in the Billing Group or Task this account cannot be edited unless all posted items and/or services have first been credited.

When the Refurbished Item is later sold or consumed COGS will be Debited and IC Control Credited in the normal way.

The Refurbishment account is required as a clearing account in order to take up the total cost of all items and services consumed or the gross margin of those items would be affected.

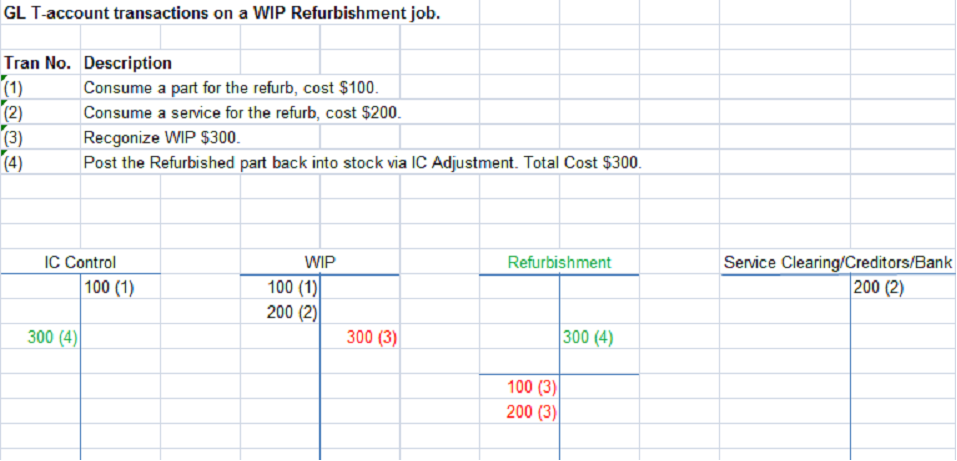

WIP Jobs

GL Posting Transactions are handled slightly differently on WIP jobs.

If processing a Refurbishment on a WIP job, when an item or service is consumed and posted on the job, WIP is debited and IC Control or Services Cost Clearing credited in the normal way as part of the Day End function.

A Refurb on a WIP job cannot be retrieved into the “Return and Refurb” program for processing to an IC Adjustment until WIP has been fully recognized.

This is a safe guard to ensure the cost debited to the Refurb Clearing account and credited to WIP, will be identical when the Refurbished Item is posted to an IC Adjustment and the reversing credit entry is passed to clear the Refurb Clearing account.

Accept

Select Accept on the Refurbishment Tab.

The refurbished item can later be sold or consumed in the usual way.

When work on the Refurbished Item is complete (i.e. the Refurbished Item has been retrieved into the “Returns and Refurb” program and an IC Adjustment has been posted), the Refurb account is credited with the total cost of the refurb and IC Control is debited.

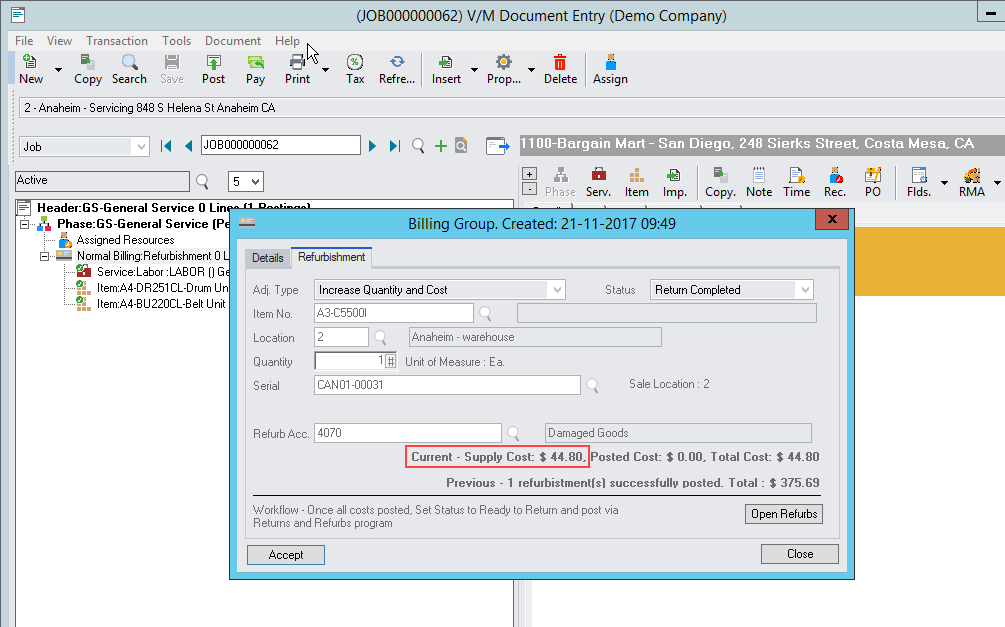

Cost details

Cost details on the Refurbishment line update as items and services are added to the billing group.

•Supply Cost - The Supply Cost shows the total value of all items and services in the Billing Group or Task not yet posted.

•Posted Cost - The Posted Cost shows the total value of all items and services in the Billing Group or Task that have been posted.

•Total Cost - The Total Cost shows the total value of all items and services in the Billing Group or Task that have been supplied and posted.

The next two screens depict examples of how GL T-accounts are affected during a Refurbishment and the order in which they take place.

Supply Items and Services

The next screen depicts the Supply Cost of all services and items to be consumed as part of the Refurbishment process.

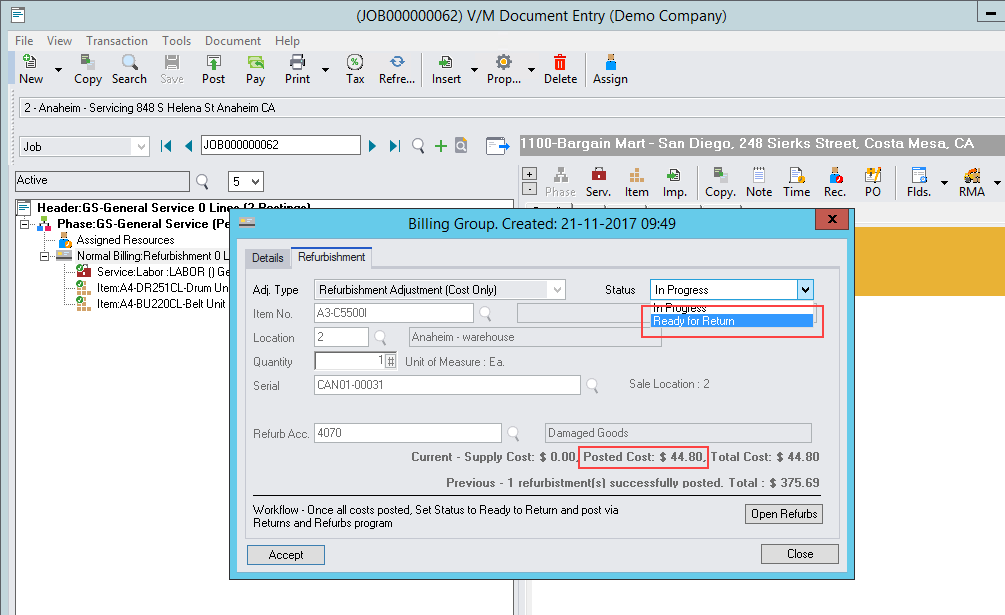

Post Item and Services

The next screen depicts the Posted Cost to date for all services and items that have been consumed in the Refurbishment Billing Group.

Set Status to Ready for Return

Once the Refurbishment is finished and the Item being refurbished is ready to be adjusted back into stock, set the Refurb Status to “Ready to Return”.

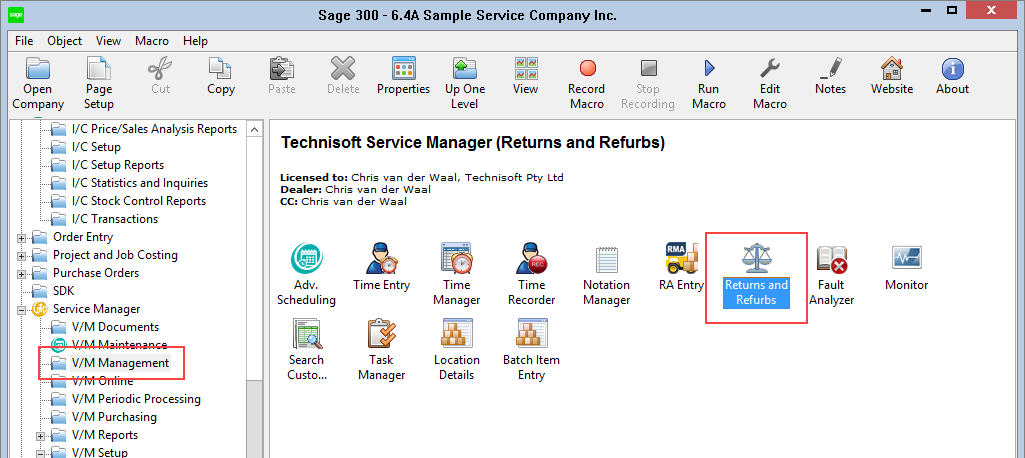

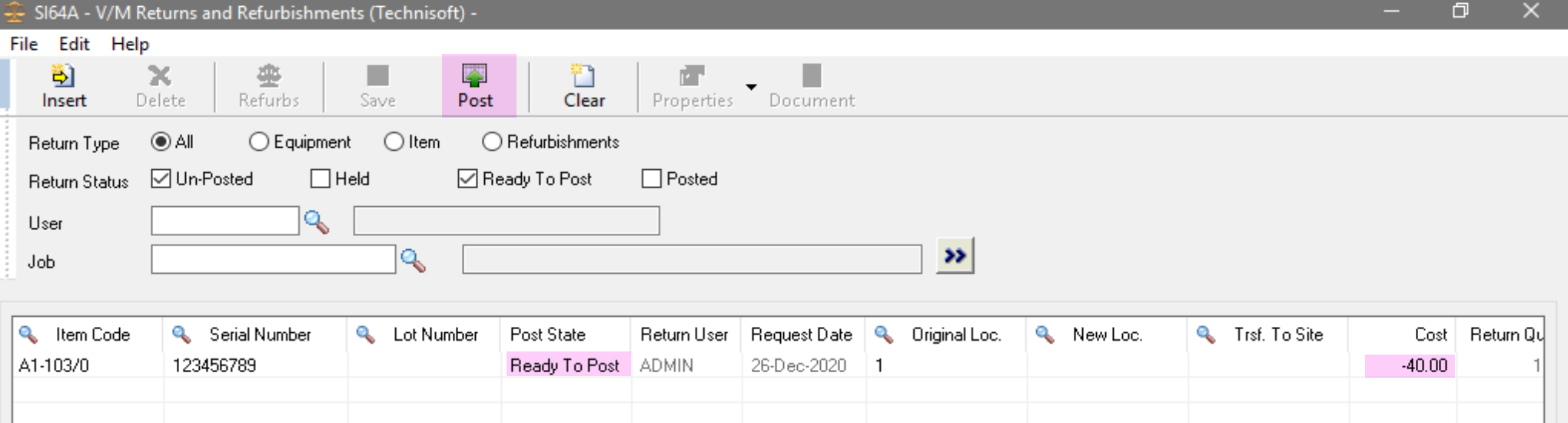

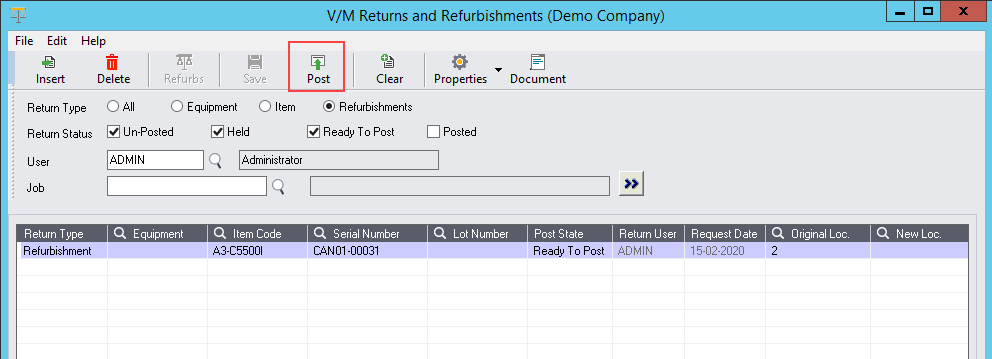

Returns and Refurbs Program

The next step is to open the “Returns and Refurb” program.

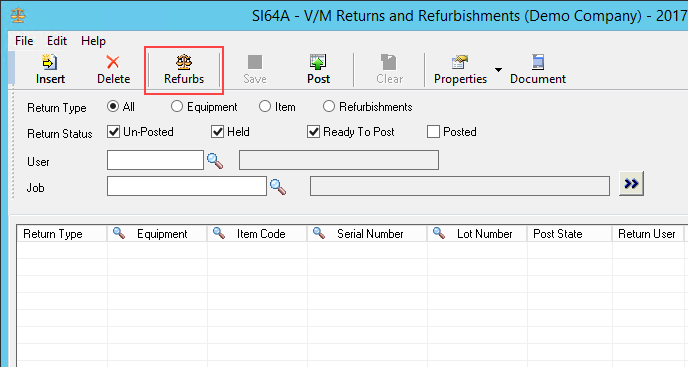

Select the Refurb icon in the top tool bar and retrieve all Refurbished Items that have been set to “Ready for Return”.

Note: Refurbishments will not be able to be retrieved unless they have been costed by Day End. It may be necessary to run Day End first.

This is a safe guard built into the Refurbishment process to ensure all entries posted to the Refurbishment Clearing account will be identical so the account will clear.

If the “Cost During Posting” method in Inventory is being used, this will not be necessary as all costs will be processed when the posting occurs in the job. i.e. if using “Cost During Posting” all Refurbishment Items will retrieve directly into the “Returns and Refurb” for posting to an IC Adjustment.

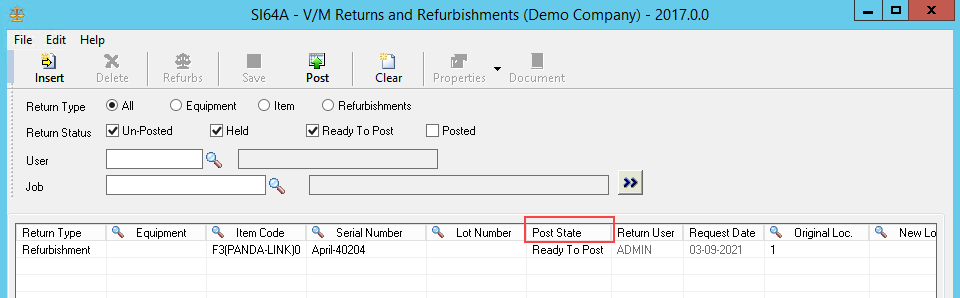

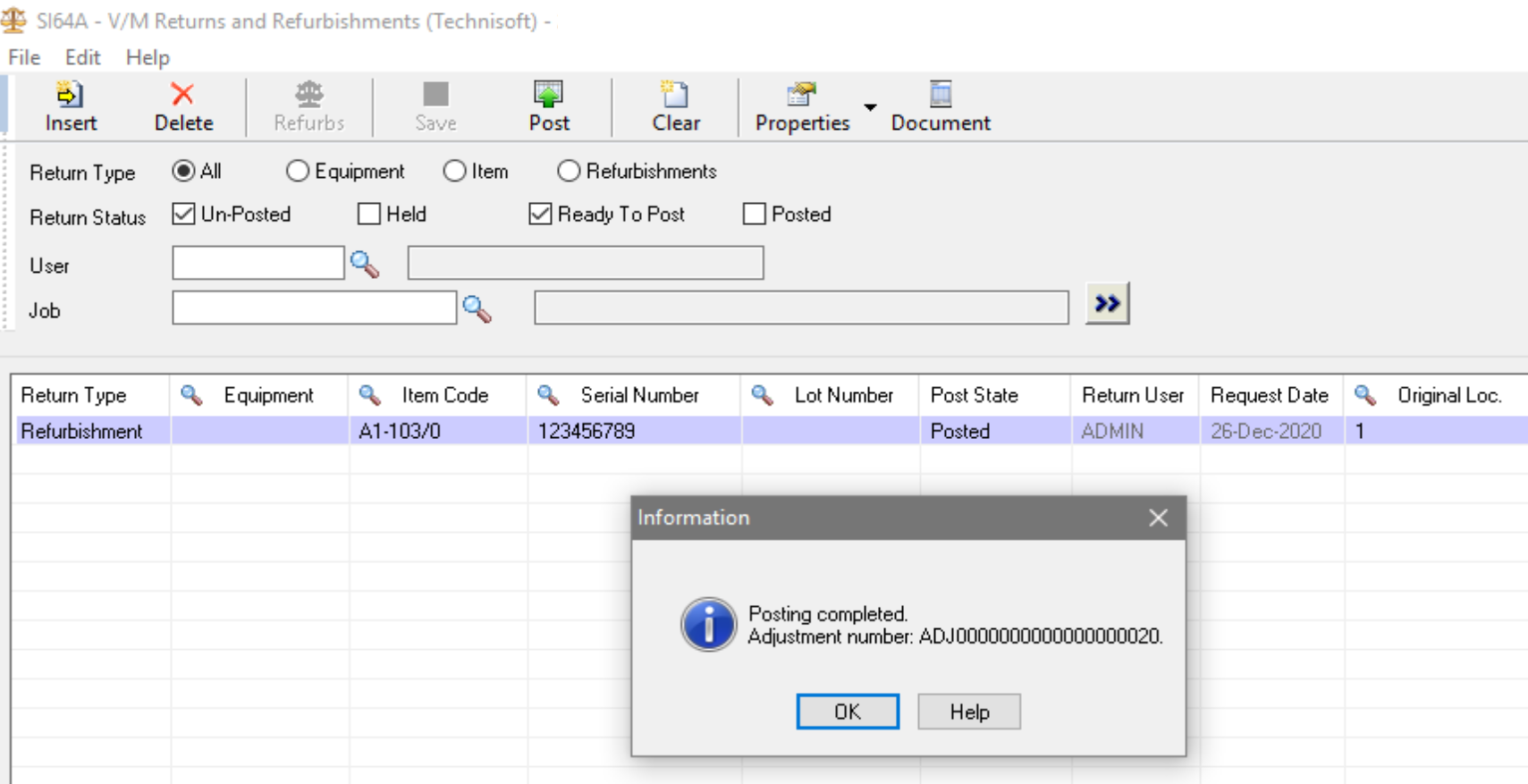

Note the Post State in the screen above was set to “Ready to Post” when the Refurbished Item was retrieved and the line is ready to be Posted.

Post the Refurbishment

Select the Post icon in the top tool bar to post the Refurbishment.

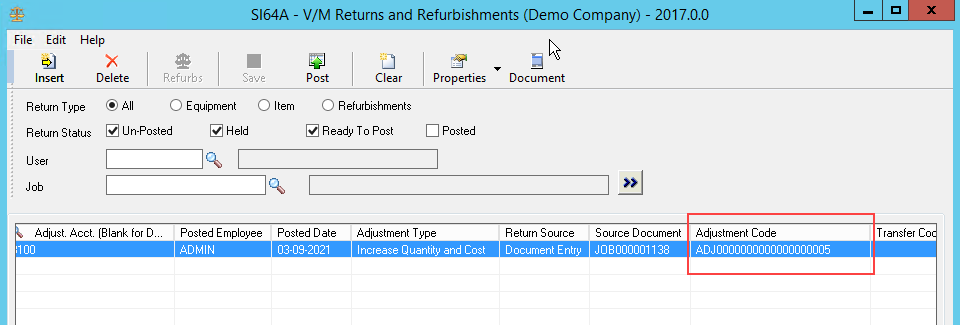

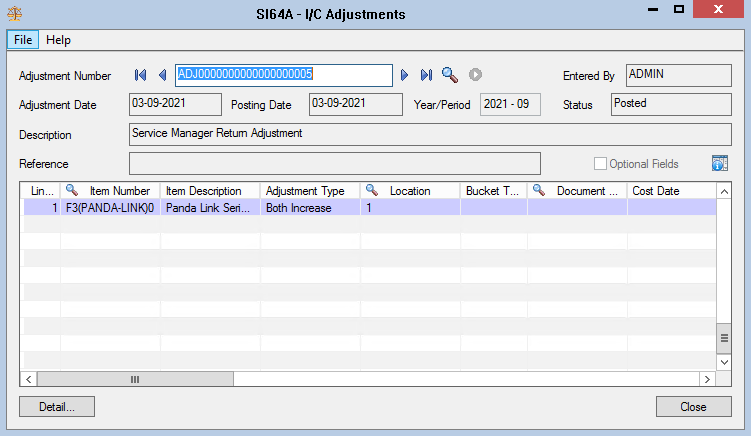

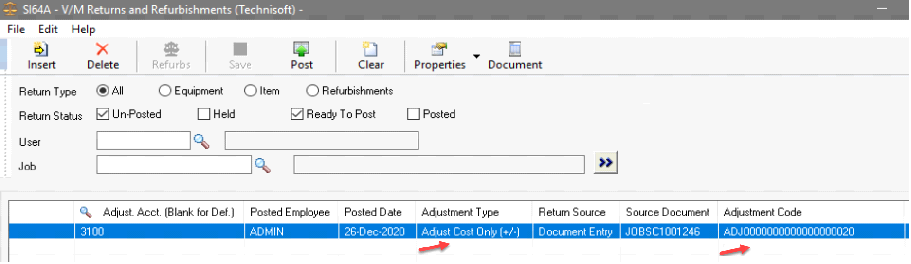

This will post an IC Adjustment directly and will return the IC Adjustment Batch Number.

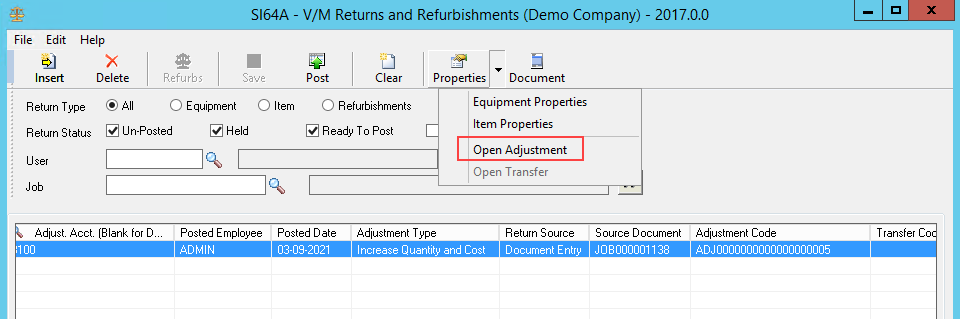

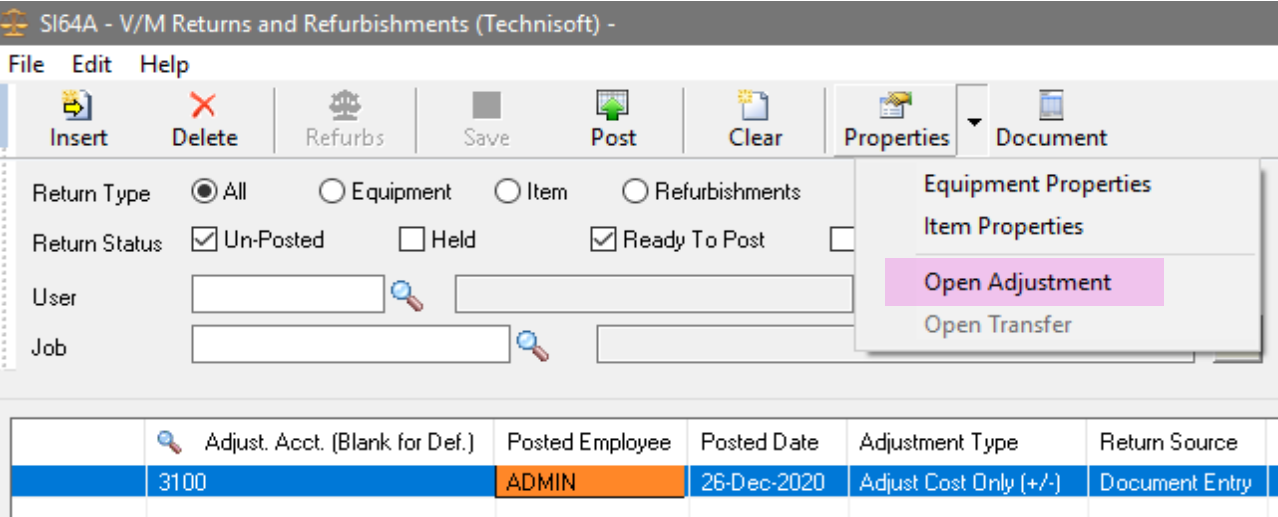

To view details of the IC Adjustment just posted select the drop down arrow on the Properties icon and choose “Open Adjustment”.

Adjusting a Refurbishment

There are two ways in which a posted and completed Refurbishment can be adjusted:

1.Add a new Refurbishment Billing Line to adjust the incorrectly posted costs.

2.Modify the existing posted and Completed Refurbishment Billing Line

New Refurbishment Billing Line to adjust previously posted refurbishments

Adding a new Refurbishment Billing line with the Refurbishment Adjustment Type option, Adjust Cost Only (+/-) allows for cost only adjustments, both negative and positive, for previously posted refurbishments that have been completed in error.

In versions of Service Manager which did not include this option, when a Refurbishment had been posted and fully returned with the status of “Return Complete”, it was not possible to modify an incorrectly posted cost or supply quantity from within the existing refurbishment as it was complete. The only way to correct the cost was to process a manual adjustment in Inventory Control which was not reflected in the job.

Adding a new Refurbishment Billing Line with the Adjustment Type Adjust Cost Only (+/-), allows the cost of an existing refurbished item to be adjusted either up or down, to correct any mistakes, late receipts or keying in issues.

Select the same Master Item that was returned and requires correction. Be sure to select the correct serial number (if applicable).

Add required Items and/or Services to the adjustment refurbishment and select the Entry Type of Credit and Return in order to adjust the original Master Item.

Note: if processing an inventory or service adjustment it is not possible to adjust cost only. That is, quantities will be adjusted as well.

If only a cost amount requires adjusting select a Service, select Credit and Return and pass a negative cost adjustment in order to update and decrease the master item cost or select Supply to increase it.

It is not possible to adjust the cost of an item that was used in the refurbishment process as items are costed by inventory and should not be incorrect. If an item cost adjustment is required that should be processed using IC Adjustments. The master item can still have its cost updated by adding a service using Credit and Return (decrease) or Supply (increase) as explained above.

Open the Returns and Refurbishment Program and select the Refurb icon to load the adjustment.

The negative Cost amount displays.

Select Post to compete the Adjust Cost Only Refurbishment Billing Group.

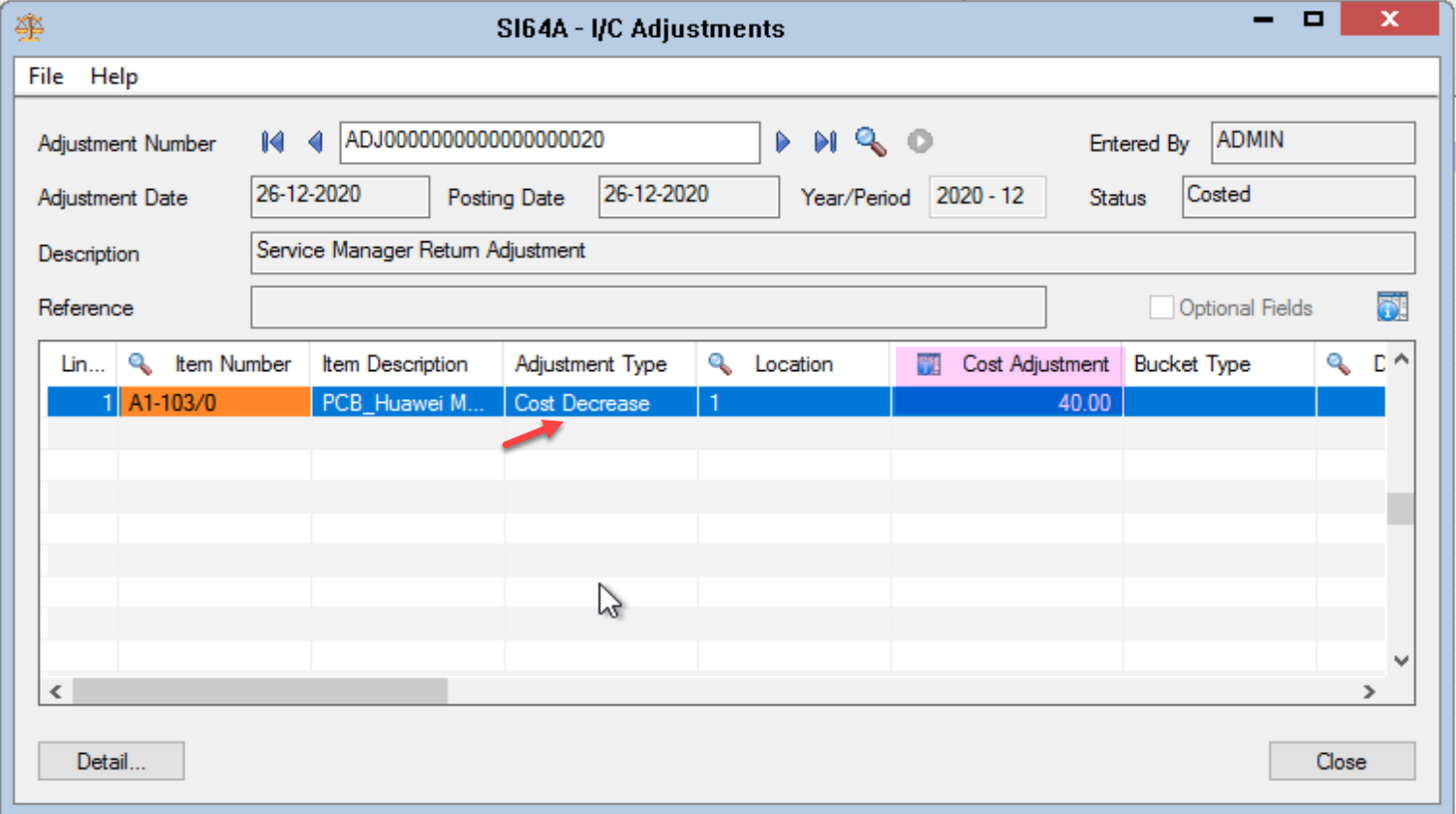

This will post an IC Adjustment directly and return the IC Adjustment Batch Number.

To view details of the IC Adjustment just posted select the drop down arrow on the Properties icon and choose “Open Adjustment”.

The Adjustment Type is confirmed as Cost Decrease

Adjust an existing Refurbishment Billing Line which has been Posted or Completed

Posted and Completed Refurbishments can be further adjusted. This can be useful where a late cost has been received or the wrong item was added to the Refurbishment.

Existing service and item lines can be edited and new services and items can be added to an existing posted and/or completed Refurbishment Billing Group.

Editing a Posted Refurbishment

In the Document containing the posted Refurbishment edit existing service or item lines or add new billing lines to the Refurbishment.

The “Entry Mode” on the item or service properties page can be changed to Credit and Return or Cost Credit Adj. to reverse previous incorrectly posted costs.

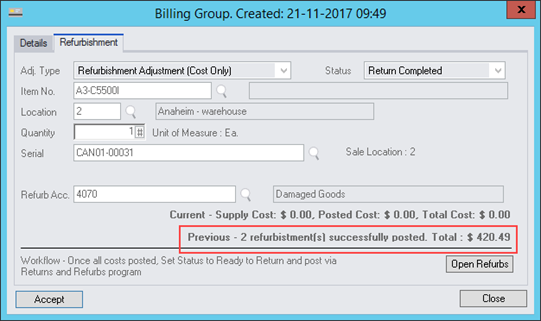

Balances of the current state of the Refurbishment are clearly displayed on the Billing group form.

“Current” represents the current on “Supply” costs. i.e. changes made.

“Previous” displays postings to date.

Post the Document in Document Entry.

After posting the refurbishment “Status” becomes editable and the “Posted Cost” is updated.

Select the status “Ready to Return”.

Next run Day End and open.

Open the Return and Refurbishment program.

Post the Return and a new Inventory Control Adjustment is posted.

Balances of the current state of the Refurbishment are clearly displayed on the Billing Group form on the Refurbishment tab.

The adjustment to the Refurbishment is complete.

Repeat the process as many times as necessary.

All adjustment GL journals are handled in the same manner as the original refurbishment.